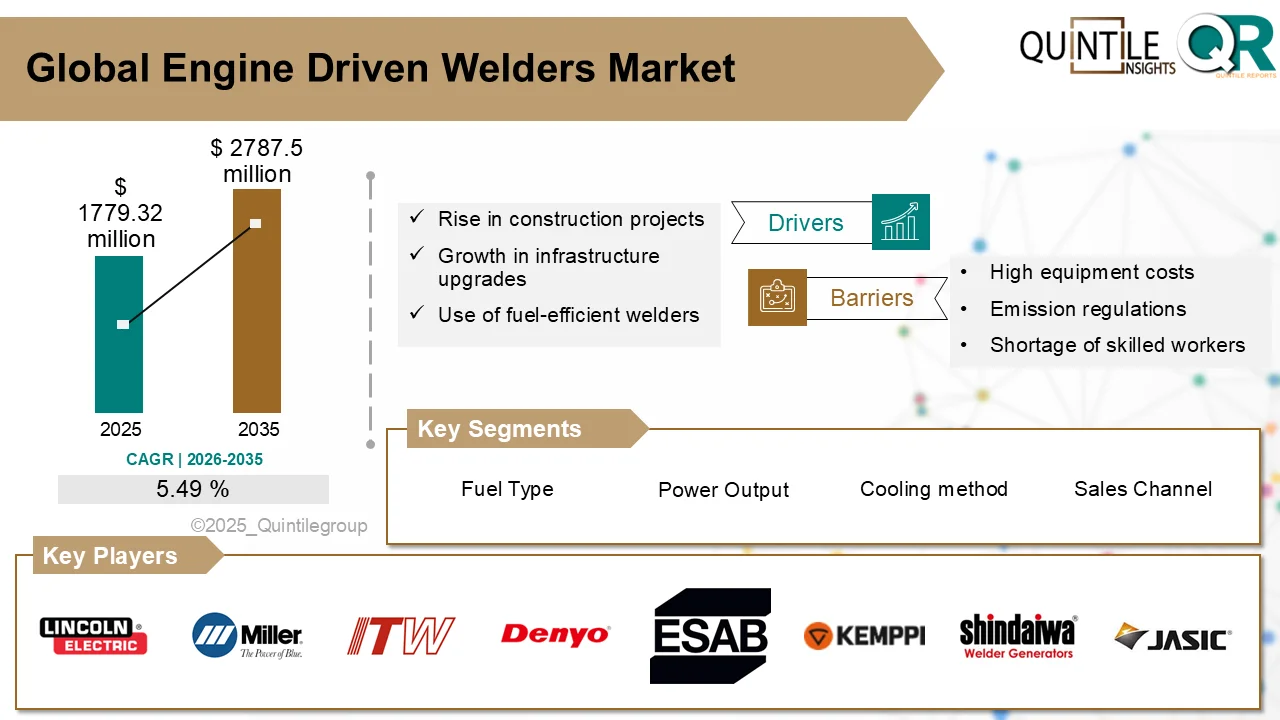

The Engine Driven Welders Market is witnessing significant growth as industries increasingly rely on portable, efficient, and high-performance welding solutions. Engine driven welders, which combine a welding generator with a fuel-powered engine, are widely used in construction, infrastructure, oil and gas, and repair applications. With growing demand for off-grid welding solutions and expanding industrial activities globally, the market is poised for steady growth through 2034.

“Request your sample report today to explore initial insights and assess report suitability.”

Market Overview

Engine driven welders provide independent power sources for welding operations, making them ideal for remote locations and construction sites where grid power is unavailable. These welders are typically powered by diesel, gasoline, or natural gas engines and support multiple welding processes such as MIG, TIG, and Stick welding.

Key applications include:

- Construction and infrastructure projects

- Industrial fabrication

- Oil and gas field operations

- Maintenance and repair services

The market growth is supported by the need for mobility, reliability, and versatility in welding operations across industries.

Key Growth Drivers

Several factors are driving the expansion of the engine driven welders market:

Industrial and Infrastructure Growth

Rapid industrialization and large-scale infrastructure projects, particularly in Asia-Pacific and the Middle East, are driving demand for portable welding solutions.

Off-Grid and Remote Operations

Engine driven welders are essential in areas without access to electricity, including construction sites, mining operations, and rural manufacturing units.

Technological Advancements

Modern welders feature improved engine efficiency, reduced fuel consumption, and enhanced safety features, increasing their adoption across industries.

Rising Maintenance and Repair Needs

Industrial and construction equipment require regular repair and welding maintenance, further supporting demand for engine driven welders.

Technology Trends in Engine Driven Welders

The market is evolving with several technological innovations:

Multi-Process Welding Capabilities

Modern welders can support MIG, TIG, Stick, and Flux-Cored welding, allowing operators to handle diverse applications with a single unit.

Fuel-Efficient and Low-Emission Engines

Manufacturers are focusing on diesel and gasoline engines with lower emissions to comply with environmental regulations.

Portable and Lightweight Designs

Compact and lightweight designs make engine driven welders easier to transport and operate at remote job sites.

Integrated Digital Controls

Advanced models include digital interfaces for current, voltage, and amperage control, improving precision and user experience.

Regional Market Insights

North America

North America holds a significant market share due to extensive construction and industrial activities, coupled with high adoption of advanced welding technologies.

Europe

Europe’s market growth is driven by industrial fabrication, automotive manufacturing, and stringent workplace safety standards requiring high-quality welding solutions.

Asia-Pacific

Asia-Pacific is expected to witness the fastest growth, fueled by large infrastructure projects, urbanization, and rising manufacturing activities in countries like China, India, and Southeast Asia.

Latin America, Middle East & Africa

Emerging regions are seeing growing demand for mobile welding solutions, particularly in oil & gas, construction, and mining sectors.

Competitive Landscape

The engine driven welders market is moderately competitive, with global and regional players focusing on innovation, distribution networks, and customer support.

- Product Innovation: Developing fuel-efficient, multi-process welders with digital controls.

- Strategic Partnerships: Collaborations with construction, mining, and industrial firms to expand market reach.

- Regional Expansion: Targeting high-growth regions such as Asia-Pacific and Latin America to capitalize on infrastructure development.

Key Players Operating in the Engine Driven Welders Market are as follows:

- Lincoln Electric Holdings, Inc.

- Miller Electric Mfg. LLC (ITW Welding)

- Denyo Co., Ltd.

- ESAB (Colfax Corporation)

- KEMPPI Oy

- Shindaiwa Ltd.

Based on Fuel Type, the Engine Driven Welders market is segmented into:

- Gasoline

- Diesel

- LPG

- Others

Based on Power Output, the Engine Driven Welders market is segmented into:

- Below 150 A

- 150300 A

- 300500 A

- Above 500 A

Based on Application, the Engine Driven Welders market is segmented into:

- Construction

- Pipeline

- Maintenance & Repair

- Shipbuilding

- Mining

- Oil & Gas

- Infrastructure

- Manufacturing

- Energy

- Automotive,Others

Based on Cooling method, the Engine Driven Welders market is segmented into:

- Air-cooled

- Liquid cooled

Based on Sales Channel, the Engine Driven Welders market is segmented into:

- OEM,Distributors

Market Challenges

Despite positive growth prospects, the market faces challenges:

- High initial cost of advanced engine driven welders

- Fluctuating fuel prices impacting operational costs

- Competition from electric welders in areas with reliable grid access

However, manufacturers are addressing these challenges through fuel-efficient designs, hybrid models, and cost-effective solutions.

Future Outlook

By 2034, the global engine driven welders market is expected to experience steady growth. Increasing industrialization, rising construction projects, and expanding remote operations will continue to drive demand.

Manufacturers focusing on multi-process capabilities, portability, fuel efficiency, and digital controls will gain a competitive edge. With ongoing technological advancements, engine driven welders will remain essential in industries requiring mobility, versatility, and reliable welding solutions.

Key Takeaways

- Engine driven welders are critical for remote, off-grid, and industrial welding operations.

- Market growth is driven by industrialization, infrastructure projects, and maintenance demands.

- Asia-Pacific is the fastest-growing region due to rising construction and manufacturing activities.

- Fuel-efficient, multi-process, and digitally controlled welders will shape future market demand.